苏州火车站(尤其是北广场站)交通非常便利,周边和短途可达的景点非常多,无论是想逛经典园林,还是体验水乡风情,都能满足你。

(图片来源网络,侵删)

我将景点按照从近到远、交通方式为你分类,方便你根据自己的时间和兴趣选择。

第一梯队:步行可达 & 地铁直达(5-15分钟)

这些景点就在火车站“家门口”,非常适合时间紧张或刚抵达想稍作停留的游客。

山塘街

- 距离: 距离苏州站约 3公里,乘坐地铁2号线到“山塘街站”下车,D口出即是,非常方便。

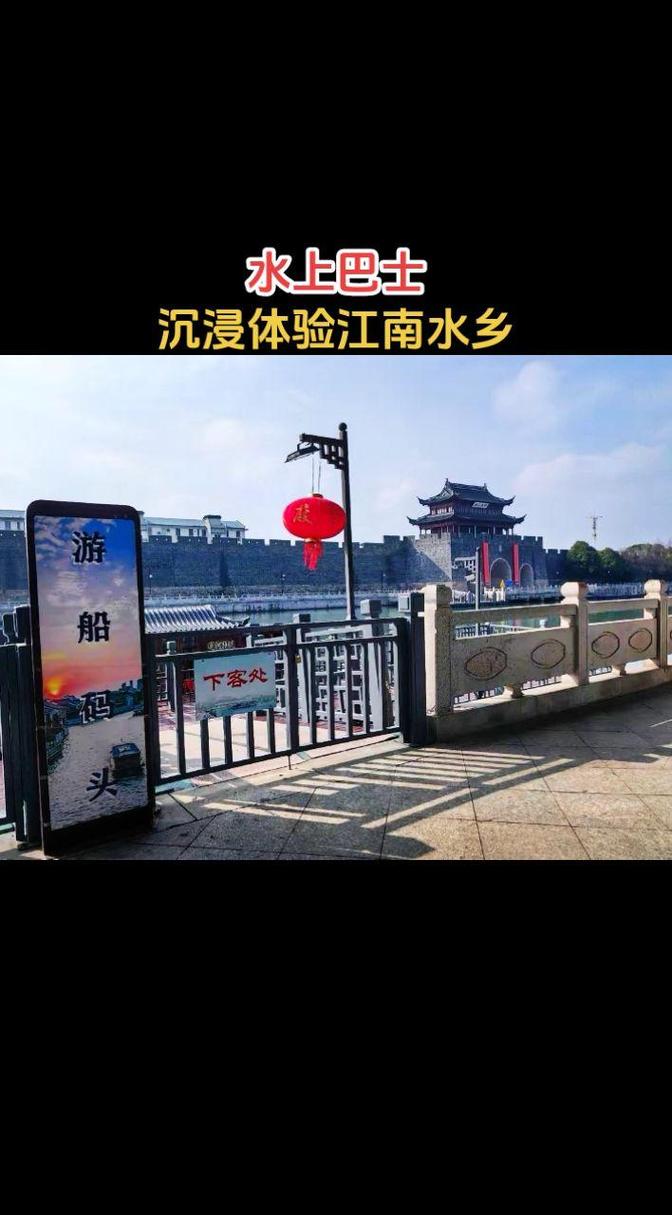

- 特色: “上有天堂,下有苏杭,中间有个山塘”,这是苏州最具代表性的古街之一,被誉为“姑苏第一名街”,你可以沿着河边漫步,乘坐摇橹船,品尝苏式小吃(如梅花糕、生煎、海棠糕),感受“水陆并行、河街相邻”的江南水乡风貌。

- 推荐理由: 交通最便利,体验最经典的苏州夜景和美食,是初到苏州的必打卡地。

- 游玩时间: 2-3小时(逛吃逛吃)。

留园

- 距离: 距离苏州站约 5公里,乘坐地铁2号线到“石路站”下车,从2号口出后步行约10-15分钟可达。

- 特色: 与拙政园、狮子林、沧浪亭并称为“苏州四大名园”,留园以其精湛建筑艺术和空间布局著称,被誉为“吴中第一名园”,园中亭台楼阁、奇石假山、小桥流水布局精巧,一步一景,处处体现着江南园林的精致与雅致。

- 推荐理由: 如果你想在有限时间内体验苏州园林的精髓,留园是绝佳选择,它不像拙政园那么大,但艺术造诣极高,且交通相对便利。

- 游玩时间: 1.5-2.5小时。

第二梯队:地铁/公交可达(20-30分钟)

这些是苏州最核心、最经典的景点,是大多数游客来苏州的首选。

拙政园

- 距离: 距离苏州站约 6公里,乘坐地铁4号线到“北寺塔站”下车,从5号口出后步行约15分钟;或换乘公交直达。

- 特色: 中国四大名园之一,也是苏州最大的古典园林,它是江南园林的代表,以水为中心,布局疏密有致,充满了诗情画意,园内的“远香堂”、“香洲”等都是必看景点。

- 推荐理由: “不到园林,怎知春色如许?”拙政园是来苏州的“必考题”,规模宏大,景色绝美。

- 游玩时间: 2-3小时。

苏州博物馆

- 距离: 与拙政园仅一墙之隔,距离苏州站约 5公里,交通方式同拙政园。

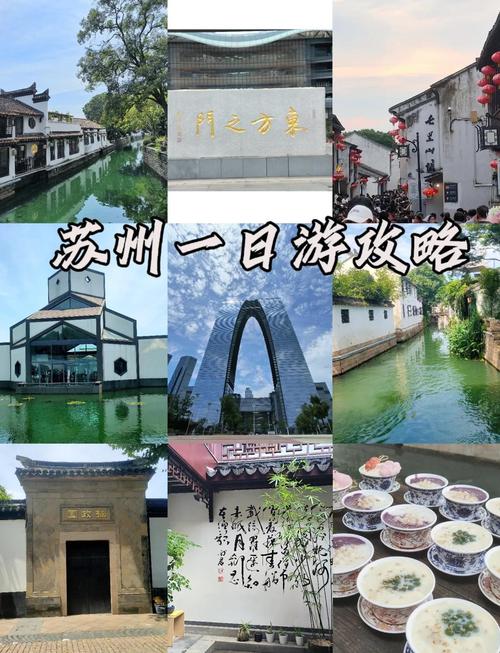

- 特色: 由世界著名建筑大师贝聿铭设计,本身就是一件巨大的艺术品,馆内收藏了丰富的苏州地方文物,包括书画、陶瓷、工艺品等,建筑设计巧妙地将现代几何与江南水乡元素结合,光影效果绝佳。

- 推荐理由: 建筑爱好者和艺术爱好者的天堂,逛完拙政园过来,可以感受古今建筑的对话。记得提前在官方公众号预约!

- 游玩时间: 1.5-2小时。

平江路历史街区

- 距离: 距离苏州站约 5公里,乘坐地铁1号线到“相门站”下车,从5号口出,步行约10分钟可达。

- 特色: 与山塘街的“热闹”不同,平江路更显“文艺”和“古朴”,这是一条沿河的古街,保留了“水陆并行、河街相邻”的古城格局,这里有评弹、昆曲等传统艺术,也有各种文艺小店、咖啡馆和民宿。

- 推荐理由: 适合喜欢安静、想深度体验姑苏慢生活的游客,可以在这里听一曲评弹,感受原汁原味的苏州韵味。

- 游玩时间: 2-3小时。

第三梯队:适合一日游(地铁/公交约1小时内)

如果你在苏州停留一天以上,或者想体验不同的风情,可以考虑以下稍远一些的经典。

(图片来源网络,侵删)

虎丘

- 距离: 距离苏州站约 6公里,乘坐地铁2号线到“山塘街站”或“广济南路站”换乘公交可达,或直接打车起步价。

- 特色: “到苏州不游虎丘,乃憾事也”,虎丘有“吴中第一名胜”之称,最著名的是云岩寺塔,俗称“虎丘塔”,是中国现存最古老的砖塔之一,苏东坡曾说:“到苏州不游虎丘,乃憾事也。”

- 推荐理由: 自然风光与人文历史完美结合,登高望远,感受“剑池”的神秘。

- 游玩时间: 2-3小时。

寒山寺

- 距离: 距离苏州站约 7公里,乘坐地铁2号线到“广济南路站”换乘公交,或打车前往。

- 特色: 因唐代诗人张继的《枫桥夜泊》——“姑苏城外寒山寺,夜半钟声到客船”而闻名天下,寺内古建筑林立,充满了禅意和历史感。

- 推荐理由: 文学爱好者的朝圣地,可以亲身感受诗中描绘的意境,尤其是在新年敲钟祈福,是苏州的一大传统。

- 游玩时间: 1-2小时。

金鸡湖

- 距离: 距离苏州站约 12公里,乘坐地铁2号线到“东方之门站”或“文化博览中心站”即可直达。

- 特色: 这是苏州现代化的代表,展现了“新苏州”的活力,湖边有东方之门(“大裤衩”)、月光码头、李公堤等,白天可以散步、看喷泉,晚上灯光璀璨,非常漂亮。

- 推荐理由: 体验苏州现代、时尚、国际化的一面,适合散步、拍照,晚上景色尤其迷人。

- 游玩时间: 2-4小时(或更久,取决于是否乘船或吃饭)。

特别推荐:古镇一日游

苏州火车站是前往周边古镇的交通枢纽,非常适合安排一日游。

- 周庄古镇: “中国第一水乡”,名气最大,商业化也最成熟,从苏州站有直达旅游大巴(约1小时车程)。

- 同里古镇: “东方小威尼斯”,相比周庄更安静、生活气息更浓,从苏州站有直达旅游大巴(约1小时车程)。

- 甪直古镇: “神州水乡第一镇”,比周庄、同里更古朴,游客较少,适合喜欢清静的游客,地铁4号线可到“甪直站”。

行程规划建议

-

半天时间(火车站出发):

- 方案A(经典古街): 地铁直达 山塘街 (逛吃)。

- 方案B(园林精华): 地铁+步行前往 留园。

-

一天时间(经典游):

- 上午: 乘坐地铁前往 拙政园 (2-3小时)。

- 中午: 在拙政园附近解决午餐。

- 下午: 步行至 苏州博物馆 (1.5-2小时),感受现代建筑之美。

- 傍晚/晚上: 步行或打车前往 平江路,体验文艺水乡夜景,吃晚餐。

-

两天时间(深度游):

(图片来源网络,侵删)

(图片来源网络,侵删)- Day 1: 上午 拙政园 + 苏州博物馆,下午 平江路。

- Day 2: 上午 留园,下午 虎丘 或 山塘街。

希望这份详细的攻略能帮助你在苏州度过愉快的时光!祝你旅途愉快!